Saturday, October 8, 2022

Boom & Bucket's Student Scholarship Program

The good folks over at Boom & Bucket have reached out to me to help spread the word on their on-going Student Scholarship Program. Please click here to learn more!!!

How to See if You’re Eligible for Temporary Forgiveness Initiatives

Hello everyone!!! I certainly hope you are well. I hope you all have settled in comfortably in the Fall Semester.

Quickly, I'd like to make you aware of two temporary initiatives announced by the U.S. Department of Education’s office of Federal Student Aid (FSA) that could get you closer to student loan forgiveness:

- A limited Public Service Loan Forgiveness (PSLF) waiver. Under the waiver, you could qualify to receive credit for additional past periods of repayment.

- An account adjustment to Income-Driven Repayment (IDR) Plans. As a result of this adjustment, you may reach IDR forgiveness sooner.

If your loan account(s) start with a “D” or “J”, this means you have Federal Family Education Loan (FFEL) Program loans held by a commercial lender(s). To take advantage of the benefits offered under these new initiatives, you’ll need to consolidate your loans into the Direct Loan Program by a specified date. Please refer to the details of each initiative below.

Want to confirm your loan types? You can log in to FSA’s Aid Summary using your FSA ID to find out how many and what types of federal student loans you have.

1. Limited PSLF Waiver

On October 6, 2021, FSA announced a temporary period during which qualifying borrowers who worked for qualifying public service employers may receive credit for past periods of repayment on loans that would otherwise not qualify for PSLF. These past periods will now count whether or not you made a payment, made that payment on time, for the full amount due, or on a qualifying repayment plan.

Borrowers with FFEL Program loans, Perkins loans, or other federal student loans will need to consolidate into the Direct Loan Program and apply for PSLF by the date the waiver ends, which has been announced as October 31, 2022.

For more information, including how to apply for PSLF using FSA’s PSLF Help Tool, review FSA’s webpage on the limited PSLF waiver.

2. Income-Driven Repayment (IDR) Account Adjustments

On April 19, 2022, FSA announced several changes related to IDR Plans that include an upcoming one-time increase to IDR-qualifying payment counts. This will allow some borrowers to qualify for IDR forgiveness sooner rather than later. Other borrowers not currently enrolled in an IDR Plan who have accumulated time in repayment for at least 20 or 25 years may also qualify for forgiveness as a result of these changes.

If your loan account starts with a “D” or “J”, you have FFEL Program loans held by a commercial lender(s). To take advantage of these changes, you’ll need to consolidate into the Direct Loan Program before FSA completes implementation of these changes (which is expected to be no sooner than January 1, 2023).

For more information about this initiative, review FSA’s announcement.

Call Your Lender to Discuss Consolidation

They will be happy to discuss the considerations of applying for a Direct Consolidation Loan and whether doing so would allow you to benefit under these new initiatives. They can also guide you through the online consolidation process.

Beware of Scams

Borrowers have reported hearing from so-called student debt relief companies offering assistance with these new initiatives – for a fee. You should not have to pay for assistance your loan servicer provides guidance for free. Call them instead!

Wednesday, July 13, 2022

It's Mid-Summer...and that means DOLLAR CAMP!!!

When I sit down and write a post or article it really amazes me just how fast the time goes, especially when one is looking at an Academic Calendar. I've been doing A+ for almost 6 years now and when I look back at past events or counseling sessions it's actually pretty crazy how they all seems to run into one large memory, if that makes any sense.

I'm thinking back to my first Dollar Camp Sessions in 2017 and I swear that feels like it was only LAST summer!

I digress. I too often let nostalgia take over!

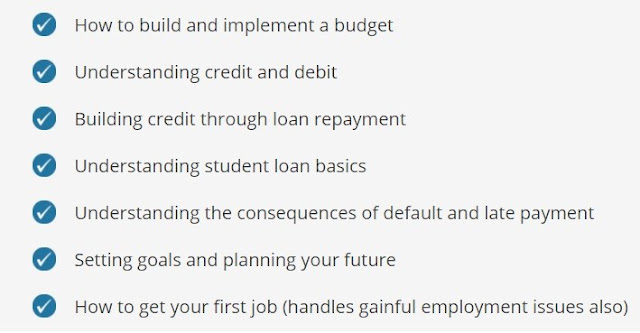

So anyhow, now that we are past my intro, my favorite part of A+, Dollar Camp is scheduled for the first week of August.

If you are not familiar, DollarCamp is a fun, immersive and most importantly, educational program designed originally for Cosmetology Schools/ Programs but now tweaked to cater to students of all studies and programs.

The sessions will be held at the gorgeous Captain Kimberly Hampton Memorial Library at 304 Biltmore Rd, Easley, SC 29640. Situated right off of Highway 123 there's easy access from both Clemson and Greenville. I absolutely love having the opportunity to utilize this venue.

Thursday, June 23, 2022

Consequences of Student Loan Default and Delinquency

The Consequences of Student Loan Debt and How to Get Out of That Hole

There is nothing quite like the thrill of going to college, getting a degree, and starting your life on your own. It is like living the dream. That is until you get that letter in the mail that says that it is time to repay your student loan. Repayment can be tough to tackle at first but it is important that you pay back what you owe or you could end up in a financial hole. Here at A+ Financial Aid, we are here to tell you about the importance of repaying your loans and a few tips for how to do so.

Account Issues

If you either decide to not pay your loans at the due date or you don’t think you have the funds to make your payment then you will start to have account issues. After 90 days, your loan payment will become delinquent, which means that you will be reported to the three major credit bureaus. If that happens then your credit score will start to fall, and if you don’t start paying, then you could have trouble making large purchases in the future, like a house or a car.

In the case that you still do not pay within 270 days, your account will then go into default. That means that the entity that provided your student loans will then give your account over to a collections agency, and from there, you will start to get calls from collectors asking for their money. It is an unpleasant experience that most people want to avoid.

Collectors

The agents at the collections agency will call you and the people you are associated with until they get a hold of you. If they are unable to get a hold of you, or they do and you are uncooperative, then they will refer your account to a higher power, most likely the federal government.

At that point, they can take more drastic measures, including garnishing your paycheck. That means that the government will start to take money away from you every payday, sometimes up to 15%. If that doesn’t work, then the next step may be to seize your tax refund, which is not ideal if you have a family to support.

School Problems

If your loans are in default and you ever decide that you want to return to school then you may not be able to enroll. That will likely be the case because you may not be able to get new school loans if you haven’t paid back the old ones.

The good news is that all is not lost. Talk to the collectors who call you and ask to be put into a loan rehabilitation program or ask to settle your loan. You won’t get a new loan right away but in three-nine months, you will be free to enroll again.

Repaying Your Loans

While you can settle with the collection agency, the easier way to go is to pay back your student loans when the bills arrive. That way, you can enroll in school right away and you won’t be punished by the government. If you need to make some extra money, consider getting an additional part-time job or finding a side hustle like driving for a food delivery company or becoming an online tutor.

Another option is to try and start your own business. You can begin by applying for a bank or private lender loan so you can get the materials you need and start your operations. If you go with this option then you will want to be current with your student loans or the chances of getting a new loan are slim to none. After that, you can begin to market your product online, make your own website, and start charging for your services.

Whatever method you use to pay back your loans, it is important that you take this matter seriously. That way, you won’t be faced with garnishment or tax penalties and you’ll get the loans paid off faster. If you would like to know more about the advice discussed here, then check out A+ Financial Aid and our helpful blogs.

Thursday, March 31, 2022

April 2022 Update and A Guest Author!

Hello friends!!! It has certainly been awhile! Five months since I last posted and I certainly hope everyone is well!

I apologize for my absence here, however I have still been in contact with my existing clients and am currently on hiatus from taking on new students as I am currently involved with another project through the Philanthropy Department with The Shriner's Hospital For Children of Greenville, SC. A+ is still running, and with the current dip in Covid I am keeping my fingers crossed that at the 2 year mark now, we may have finally figured out a way to at the very least co-exist. As I have mentioned prior, A+ has taken a substantial hit due to the pandemic; however I know I am certainly not alone in this predicament and I anticipate a full return to business hopefully within the next 12 months. This venture wasn't built overnight, nor shall it fall that quickly!

In the meanwhile, (and I certainly apologize to him) I have a guest author today who has put together a really wonderfully written piece on minimizing student loan debt which I would like to share. It is written by Mr. Michael Stephenson from TheEntrepreneurHub.com. Thanks Michael and I look forward to our next post. Be back soon!

Image via Pexels

Minimizing the Long-Term Debt Associated with a College Education

Most people genuinely want to attend college. However, a big barrier for some is the long-term debt that a college education tends to come with. Student loans can be lifelong commitments, and they can make living after earning a degree very difficult. If you’re considering college but haven’t pulled the trigger due to fears of debt, you aren’t alone. Thankfully, there are some ways to minimize the long-term debt associated with college. Here’s how, presented by A+ Financial Counseling and Literacy.

Work While You’re in School

This isn’t the most glamorous way to minimize your long-term debt, but it is one of the most effective ways. The more money you’re able to earn during your time at college, the less you’ll have to take out in student loans. Juggling a part-time, or even full-time, job and school is difficult, but it can be done. It just requires focus and adequate planning.

Apply for Grants and Scholarships

When you’re considering college, it’s important to take advantage of the many grants and scholarships that are available. In most cases, the money distributed through these programs doesn’t have to be paid back, as long as you’re doing well in school. Check out what grants and scholarships are available based on:

● Merit: How well you’ve done in school up to this point

● Demographics: Some grants and scholarships are available to students with specific backgrounds

● Area of Study: Many in-demand degrees have a large number of grants and scholarships associated with them

As you prepare to apply for these programs, be sure that your writing skills are up to par. Many require an essay or other written form of application.

Consider Online Degree Programs

There are many online degree programs available that are identical to on-campus programs. Often, these online options are much cheaper than their counterparts. Many popular degrees can be obtained online while you go about your regular daily life. Things like working and family obligations can still be tended to. Earning a degree in subjects like computer science is possible through an online degree program.

Understand Your Loan Options

Not all student loans are the same. If you have to take out student loans to pursue your education, be sure that you fully understand them. Some will have higher interest rates than others. Still, some student loan options have variable interest rates, meaning they can rise and fall. This can have a great impact on your student loan debt over time.

Buy Used Books

This doesn’t seem like the biggest impact on long-term debt, but you’d be surprised. Many required textbooks for college cost hundreds of dollars when they’re new. When you buy these books in used condition, you can pay a fraction of that price. A lot of the time, you can even use past editions, as long as you’re aware of the changes that were made.

Live Off-Campus If Possible

Living on campus is a ton of fun, but it’s also very expensive. If you can, find a place that’s close to campus to live. You’ll save a ton of money on room and board alone and greatly reduce your overall student debt.

You don’t have to drown in college debt for the rest of your life. By following a few simple tips you can reduce the long-lasting impact of student loan debt.

Sunday, October 31, 2021

Bullinger Memorial Scholarship Award Recipient and a New Corporate Partnership

Hello all! I certainly hope you are well. As you may have noticed I have not posted in a few weeks. If you are familiar with my organization, you'll know that over 90% of my client base comes directly from in-person school gatherings, coordinated youth group presentations, and so on.

With the continued mandates governing municipalities, A+ has been unable to maintain the high level of support it has in past years. I have not been presenting in front of large groups for some time. I do continue to oversee my current enrolled student base as well as the occasional one-off appointment. For the (hopefully) foreseeable future, I have scaled back the scope of A+ and am currently only operating with Anderson (SC) School District 1.

I hope to expand as mandates are loosened and hoping for a controlled spread of Covid this Winter as compared to last.

I am still here and still in operation. I continue to monitor the ins and outs of Federal Aid and its Administration through NASFAA (National Association of Financial Aid Administrators) as well as other publications and reliable news sources.

I also enjoy keeping in touch with peers as I am able to get a feel for what things are like at the "front lines."

I certainly realize I am not the only person or my organization is not the only one feeling the continued brunt of Covid, but I would be lying if I said I didn't long for the days when I was operating at (above) capacity! I don't see myself throwing in the towel. Life goes on, and students are still facing the challenges of Financial Literacy which is forever my crusade!

In better news...it was perhaps two months ago, but I was happy to present the George M. and Margaret E. Bullinger Memorial Annual Scholarship to Jake Chen, a graduated Senior from Wade Hampton High School (SC). The Scholarship, given every Summer, is awarded to a client who best presents an outlook on The Future of Financial Aid. Jake offered a wonderful PowerPoint presentation on how flipping A+ Financial Counseling into a Podcast to reach a further audience. His presentation was SO thorough, it has me completely second guessing my own structure and I'm afraid of him taking over!!! :) It is a $1000 grant which can be used for School-related expenses as necessary.Jake is studying Acoustical Engineering at Georgia Institute of Technology in Atlanta, so I made sure I gave him the scoop as to where to (and where NOT) to go, as Atlanta is where A+FC&L was born.

Congrats and Good Luck Jake!

Secondly, I have recently been contacted by Mr. Enmanuel Batista, an Outreach Coordinator with Education Loan Finance, an outstanding organization designed to assist potential and current college students apply for Scholarships. I am happy to partner with them and will set up a link on the right side bar that you can access any time. I truly believe you can never have too many partners to help navigate these waters, as we all share a common goal.

Well that is all for now. Please take care, and Happy Halloween!

Tuesday, August 17, 2021

Certified Nursing Assistant Scholarships: Deadline September 21, 2021

Hello, I hope you are all well! Certainly I did not anticipate starting this post off with another take on Covid-19; but unfortunately it has peaked once again right before the traditional start of the Fall Semester. I will not sit here and tell you all what you should be doing, actions necessary, loan forbearence, etc. Sadly I believe we've covered that quite a bit over the last 18 months or so.

Please, if you haven't...get vaccinated.

Anyhow, some much better news. I was contacted very recently by Ms. Ashley Grader with CNAClassesNearMe.com They are offering 2 scholarships for students to apply for who are entering a Certified Nursing Assistant (CNA) program.

The first deadline is September 21, 2021 for $500 and the second $500 is due by April 2, 2022.

The links are as follows:

https://cnaclassesnearme.com/cna-scholarship/

https://cnafreetraining.com/about-us/cna-free-training-scholarship/

From Ms Grader:

"The amount awarded for the scholarships is $500 each. The deadline to apply for the CNA Classes Near Me scholarship is on September 21 and CNA Free Training scholarship is April 2. A little information about both of my websites:

"CNA Classes Near Me" helps those interested in becoming a Certified Nursing Assistant (CNA) find training programs. Many of these programs are free as they are funded by the U.S. Department of Labor or state equivalent agencies. Our site has state by state pages that list out all training locations in a given state as well as their contact information.

"CNA Free Training" provides free training materials for those preparing to take the CNA exam, which is a requirement in order to become a licensed CNA. We have free practice tests for each section of the CNA exam, as well as supplemental training materials that can be used while taking CNA classes – all of which are free."

She encourages anyone with questions to reach out to her at ashleygrader@gmail.com.

Wednesday, July 7, 2021

DollarCamp Sessions!!! July 28-29th 7pm-9pm Furman University

Can we remove 2020 from the calendar? Has Congress passed that yet? Because it has been TWO YEARS since I held my last DollarCamp session and this is one aspect (among many others) that I absolutely love conducting!

The sessions will be held at Furman University's ROTC Paladin Battalion Office at 3300 Poinsett Highway, Greenville, SC 29613. I'd like to thank the good folks with the Paladin Battalion for partnering and allowing use of their classroom. See you there!

Tuesday, May 11, 2021

Bottom Line? Tell Colleges What You Need.

It is not too late. Trust me.

Last year, in the depths of pandemic uncertainty, many colleges extended their traditional deposit deadlines by a month or more to give students and families more time to assess their financial situation and consider options. This year, many colleges have reverted to May 1 (or in many cases, beyond) since the first of the month falls on a weekend — as “decision day."

If your decision depends on the financial aid offer, you can still ask for a review of your aid package, especially if your finances have changed. Often, schools can render decisions within a few days. And some institutions may even extend your deposit deadline, if you ask. Colleges are keenly aware that families may require flexibility.

One big factor this year is that the Free Application for Federal Student Aid — the gateway to federal as well as state and much institutional financial help, known as FAFSA — required students to report financial information from 2019. So families that fell on hard times during the pandemic may find their aid offers don’t reflect their true situation.

If the pandemic has caused a significant decline in income, a job loss or added medical expenses, you should let the school know. College financial aid officials have discretion to use “professional judgment” to increase aid if a student’s circumstances have changed. Many students are unaware that they can appeal aid offers, but it’s a rather common practice.

FormSwift, a digital document company, has created SwiftStudent, a free tool to help students file appeals. The foundation sought advice from colleges and financial aid professionals to design the tool. It explains the appeals process and provides templates that students can use to write letters to submit to their colleges. Its absolutely brilliant and I cannot recommend utilizing it if needed, enough. It allows and empowers students to advocate for themselves.

This year, it’s particularly important for students and parents to know they can file an appeal, and that it’s not an unusual step.

In a survey last fall, college financial aid counselors reported “notable” increases in requests for professional judgment reviews, according to the National Association of Student Financial Aid Administrators. The group will conduct another survey next month to update its findings.

Here are some questions and answers about financial aid:

I’m confused by my aid letters. How can I make sure I am correctly comparing offers?

Colleges are encouraged to use standard formats for aid letters and avoid jargon, but not all do. Be careful to distinguish between “gift” aid, like grants and scholarships, which doesn’t have to be repaid, and loans, which do. Subtract the gift aid from the college’s cost of attendance — the total cost of tuition, housing, meals, books and supplies — to get a net price. Do this for each school before considering how much of the cost you can cover from savings and earnings, and how much you would have to borrow to cover any shortfall.

A nonprofit group that works to help students afford college with less debt, uAspire, created a free online cost calculator to help applicants make “apples to apples” comparisons of aid offers. The Consumer Financial Protection Bureau also offers an online tool to compare offers, and the Institute for College Access & Success offers a tip sheet.

And remember: You aren’t obligated to borrow all, or any, of the loans that are included in your aid letter. In fact, try to utilize as little loan funding as possible, opting for Federal over Private. On the other hand, some colleges may not include the maximum amount of federal student loans for which you are eligible. So if you think you may need to borrow more, call the financial aid office to discuss your situation.

What documentation do I need when making a financial aid appeal?

Colleges vary in how they evaluate an appeal. But gather anything that shows reduced hours or wages, like letters from employers, pay stubs or unemployment records, as well as medical bills, to help make your case.

Can I make an enrollment deposit at more than one college?

Colleges frown on this practice since you ultimately can’t attend more than one college, and making two deposits means another student — one on the wait list, or a late applicant — won’t be offered a spot. It also works against less affluent applicants, who may be unable to afford more than one deposit. Generally, Admissions Representatives will try to discourage this.

While it was possible that a school could rescind an offer of admission for violating the terms of the deposit agreement, it might be difficult for the college to know that a student has submitted multiple deposits.

(It’s generally deemed reasonable if students are on a wait list for one college and make a deposit at a second college in case the first institution never accepts them.)

Students and their families may be torn, however, given the unusual circumstances of the pandemic.

However if students were unable to visit a campus because of Covid-19 restrictions and want to see it in person before committing, he said, they may decide to make two deposits to hold their spots before choosing.

The downside? Deposits, often as much as $500, are typically nonrefundable. Plus, according to the College Board, which administers the S.A.T. and other college tests, some colleges reserve the right to rescind an offer of admission if they discover that a student has made a double deposit.

Another option is to contact the college, explain your situation and request more time. Students should be honest and direct and ask for what you need.

Sunday, March 28, 2021

New Community Partnerships

On behalf of A+ FC&L, I am extremely delighted to announce two major partnerships with two tremendous members of the Upstate South Carolina Community.

First, Shriners Hospital for Children in Greenville. I have had the opportunity to partner with their Philanthropy and Volunteer Groups and have been asked to join their Financial Literacy Program for Families. This I believe will allow me to broaden my counseling to include Medical bills, cost of care and balancing family budgets. I am extremely excited about this new venture and am honored to be added to their team!

Secondly, I have agreed to a partnership with Concord Baptist Church in Anderson, SC. As a member of their panel of Youth Athletics, they have looked to expand my role in offering Literacy Sessions for High School Juniors and Seniors and their families preparing for college. (Just as a quick side note, A+ FC&L has and remains to be a secular organization. I do indeed have many strong partnerships with many wonderful churches and religious affiliated groups; however our relationships are strictly on a professional/service-based level.)

In this difficult year, I am so very excited to be able to make these announcements as although we have been shackled at times during the pandemic, the importance of good financial sense never really takes a back seat.

More to come as events are solidified!

Sunday, February 7, 2021

February Is Financial Aid Awareness Month...And I Am Back!!!

Where does one even start when describing the past year? Early February of 2020, COVID-19 was still a "China" problem with most reports and news coming out of Wuhan and surrounding areas. Little did most of us know that a month later, society as we knew it in America would for all intents and purposes be shut down.

Its a fairly safe assumption to say that close to, if not exactly 100%, of our nation's citizens have been affected in some capacity; some more so than others. Casualties not only include death tolls, but jobs lost, school days missed, mental health challenges, financial uncertainties …the list goes on. It has been so very difficult.

I cannot speak for anyone else, but A+ has been severely impacted by Covid; as the majority of my contacts and clients are originated through public gatherings in the community and at schools. Needless to say, both avenues have presented numerous roadblocks. However, I have continued to work with many families and students over the past 11 months, and have found that they have been more at ease and accommodating than I have. I believe it was this fear of being asymptomatic and passing it along to an unsuspecting client/family.

Fortunately this has not been the case and my personal face-to-face interaction has been extremely limited, opting for more virtual routes.

But, I am here to announce that at long last, just shy of one year, I will be holding THREE in-person Financial Aid Counseling sessions! I am so excited and absolutely terrified at the same time! Not so much of the virus, rather my ability to multitask the Aid process!

The come-and-go sessions will be held at The Powdersville Public Library located at 4 Civic Ct., Powdersville SC 29642. There is quick on/off access to both I-85 N and S.

The times and dates are follows:

- Tuesday February 23, 3pm-8pm.

- Thursday February 25, 3pm-8pm.

- Saturday, February 27, 10am- 3pm.

I have reached out to my contacts at most Upstate High Schools regarding the events. Anderson, Oconee, Pickens, Greenville and Spartanburg County students should also be receiving a follow up email. Please DO NOT contact the Library for information. Please reach me here or at (864) 593-0010.

Myself and two colleagues will be available to assist with submitting the Free Application for Federal Student Aid (FAFSA) and scholarship applications. Reservations are not required, and students should bring their (and parent if applicable) 2019 income tax information with them.

During the event, prospective students can apply for admission to ALL SOUTH CAROLINA TECHNICAL SCHOOLS discounted at $30, and get assistance with financial aid applications. Participants will receive a will be scheduled for a future advising appointment.

Health and safety guidelines will be followed, with face coverings and 6 feet of physical distancing required, room occupancy monitored, and rooms sanitized frequently. Admission will not be allowed without face masks per State and County guidelines.

We will be ordering pizza for the evening sessions so if mom and dad have to come straight from work we got you covered!

I am beyond thrilled to have this opportunity and thank the County of Anderson (SC) to once again have access to the Powdersville Public Library where I have had so many successful sessions over the years!

Wednesday, December 23, 2020

UPDATE: Second Coronavirus Relief Package NOT Extending Student Loan Forbearance

At long last, Monday, Congress approved a second coronavirus relief package that includes $600 stimulus checks for many individuals — but no additional student loan forbearance for borrowers.

Back in March, the CARES Act paused federal student loan payments and interest, giving many borrowers a break. Earlier this month, Education Secretary Betsy DeVos extended that forbearance through January 31, 2021.

The new stimulus deal doesn't offer any additional extensions on student loan forbearance, but the current expiration date leaves enough time for President-elect Joe Biden's team to take over in January 2021 and offer additional relief.

When will student loan payments restart?

As of now, student loan repayment is expected to restart after January 31, 2021, meaning no payments will be due and no interest will accrue until that date. For those on income-driven repayment plans, each month of forbearance counts towards the number of payments required for forgiveness.

This forbearance only applies to federal student loans, though some private student loan lenders have offered assistance to affected borrowers on a case-by-case basis.

What's in the bill for borrowers?

While the new economic relief bill didn't extend forbearance, there are some provisions students and borrowers should be aware of.

The bill makes changes to the federal Pell Grant program for the 2021-2022 school year, allowing a maximum grant amount of $5,435 per student, per year which I will go into further a bit later.

It also expands a lesser-known benefit of the CARES Act: a tax break for employers that help employees repay student loans up to $5,250 per year of educational assistance.

The CARES Act changed a section of tax code providing a tax break for employers that give educational assistance to employees, adding student loan repayment to that definition. The new stimulus deal extends eligibility for this program through January 1, 2026. Only 8% of employers offered this assistance in 2019, according to data from Society for Human Resource Management, but this extension could increase that figure, the group says.

Will the Biden administration extend student loan forbearance?

President-elect Joe Biden's inauguration on January 21, 2021 could bring additional relief: Biden has discussed student loan forgiveness, and has recommended giving student loan borrowers $10,000 for coronavirus relief. However, it's unclear what the incoming administration will do once in office, and what Congress will agree to. It is fairly safe to say at the very least, the forbearance will be pushed far past the current January 31 deadline.

Sunday, December 13, 2020

Student Loan Relief Pushed out to January 31, Likely Longer

With little to no surprise, individuals with student loans will get another month of relief after Education Secretary Betsy DeVos extended the pause on student loan payments through January 31.

Borrowers haven't had to make payments since March, but the relief was set to expire on December 31. DeVos also extended the pause of interest accrual, as well as the suspension of collections on defaulted loans.

In an unprecedented move, President Donald Trump originally waived interest on student loans in March as large parts of the economy began to shut down in response to the coronavirus pandemic.

A broader version of student loan relief was included in the $2 trillion economic stimulus package signed into law two weeks later. Under the program, the US government automatically suspended payments and waived interest on federal student loans through September. Trump later moved the expiration date to the end of the year by executive action.

Congress has yet to approve more pandemic aid despite months-long negotiations over another broad stimulus package, but with the Christmas/ New Year Holiday Break looming, it appears that this will not happen before the end of the calendar year.

The suspension and interest waiver applies only to federally held loans. That covers roughly 85% of all federal student loans, including those known as Direct federal loans and PLUS loans that parents can take out on behalf of their children.

It excludes some federal loans that are guaranteed by the government but not technically held by it. Generally, those were disbursed prior to 2010.

While borrowers won't have to make payments through January 31, they will continue to be able to do so and benefit from the 0% interest rate. If you have the means, this is an excellent time to keep paying on these loans. Think of "0% financing on a new car," for example.

Those enrolled in the Public Service Loan Forgiveness payment plan will still receive credit toward the forgiveness program as if they had continued paying, as long as they are still working full time for qualifying employers.

Monday, November 16, 2020

Will President-Elect Biden Be Able To Deliver On His Student Loan Forgiveness Proposal?

Now that he's been elected, the 42 million Americans with education loans may be wondering: Will it really happen?

To begin, what Biden proposed was a scaled-down version of the debt forgiveness plans that his rivals to the left in the Democratic primary campaigned on. Sen. Elizabeth Warren, D-Mass., wanted to cancel up to $50,000 in student debt for individuals with household incomes under $100,000. Meanwhile, Sen. Bernie Sanders, I-Vt., had said he'd erase all of the country's outstanding education debt.

Biden laid out a narrower plan, saying he would forgive $10,000 in student debt for all borrowers, and the rest of the debt for those who attended public colleges or historically Black colleges and universities and earn less than $125,000 a year.

In all, that would slash the country's $1.6 trillion outstanding student loan tab by about a third.

Despite campaign promises, education issues are usually not a top priority for new presidents, especially with the raging Covid pandemic. That might be different for Biden, though; his wife, Dr. Jill Biden, is an educator and the student vote helped elect him.

Student debt burdens Americans more than credit card or auto debt, and more than 1 in 4 borrowers are either in delinquency or default. More than half of Americans say student debt is "a major problem" for the country, according to a Politico/Morning Consult poll. And one survey found that 58% of registered voters are in support of student loan forgiveness.

Still, the chance of passing legislation that would lower or eliminate people's balances depends on the composition of the Senate, which is still in the balance.

However, if the Democrats win both run-off Senate races in Georgia, there's the possibility that Biden could use a so-called budget reconciliation bill, which aims to cut the federal deficit, to couple student loan forgiveness with tax cuts.

A split Congress will make it more difficult to make the forgiveness a reality, as Republicans generally oppose the idea. Even if Democrats secure a majority, Republicans may use the filibuster to block bills.

Can a president forgive student debt without Congress?

There's a growing argument among the left that he or she can, and on the campaign trail Warren said she'd do just that.

Saturday, October 10, 2020

How To Maximize Your Financial Aid Package During The Pandemic

Now that the majority of Fall starts have gone official, whether in person or virtual; please keep in mind it is NOT too late to appeal your Financial Aid Award. You will want to check in with your individual institution's Financial Aid Office(s) for exact procedures.

In the wake of the Covid-19 crisis, many American families are under severe financial strain. Meanwhile, others are also facing a $40,000 college tuition bill. Nearly 40% of parents who didn't plan to apply for federal aid, now are as a result of the pandemic, according to a recent survey by Discover Student Loans.

Roughly half of parents lost income as a result of the pandemic and 44% said they can't afford to pay for as much of their child's education as they had originally planned, the survey found.

At the same time, college costs are skyrocketing.

Tuition and fees plus room and board for a four-year private college averaged $49,870 in the 2019-20 school year; at four-year, in-state public colleges, it was $21,950, according to the College Board.

For the first time in five years, the majority of college-bound seniors plan to take out a loan. This percentage had been declining steadily before spiking in 2020, according to a separate survey by college comparison site Niche.

The Free Application for Federal Student Aid, or FAFSA, serves as the gateway to all federal money, including loans, work-study, and grants, which are the most desirable kind of assistance. For the 2021-2022 school year, the FAFSA filing season opened October 1 — and, for the most part, the sooner you file, the better.

Some financial aid is awarded on a first-come, first-served basis, or from programs with limited funds. The earlier families fill out the FAFSA, the better the chance to be in line for that aid. Given the weight of this year's uncertainties, it's critical that families apply as early as possible when the application becomes available.

Some careful financial planning may improve your overall standing.

For starters, families might be able to boost their chances by considering how their assets will be measured in aid calculations.

For example, if you have credit card debt and cash in the bank, it is better to pay down the debt and show less cash on hand. (Most types of debt, including credit-card debt, car loans and the mortgage on your primary residence, are not reported on FAFSA and as a result don't reduce your family's net worth in aid calculations.) You want to apply when you demonstrate the most need.

In addition, keep in mind that financial aid is calculated based on a family's income from two years earlier. So, if you're filling out the FAFSA for the 2021-2022 academic year this October, it's your income in 2019 that's considered.

Those figures could be significantly larger than the reality many people are facing today due to the pandemic.

Families who have experienced a financial shock due to Covid-19 should reach out to the college financial aid office and ask for a "special circumstances" form to account for any changes in 2020, such as a job loss or furlough. (I also have a very helpful guide to Special Circumstance Award Requests which is available by request via PowerPoint.)

In previous "ordinary" years, high school graduates miss out on billions in federal grants because they don't fill out the FAFSA. Many families mistakenly assume they won't qualify for financial aid and don't even bother to apply.

This year, schools have increased their aid budgets and there are many people previously might not have qualified in the past that could still get aid.

In other words, 2020 is a buyer's market.

Sunday, September 27, 2020

Students and Financial Literacy with Annuity.org

Occasionally my partners will reach out with a new article, or post, or blog entry with relevant information to the A+ program. The good folks over at Annuity.org presented me with an absolutely exceptional piece authored by Catherine J. Byerly, one of their talented Staff Writers.

Much of the information may look familiar from topics I have discussed here or in person, but I always welcome relevant articles from different sources as they may offer some tips, calculators, charts, etc. that I may have not covered.

Please feel free to give it a read, there could very well be something in there that answers some questions you may have had about Financial Aid Literacy.

Boom & Bucket's Student Scholarship Program

The good folks over at Boom & Bucket have reached out to me to help spread the word on their on-going Student Scholarship Program. Ple...

-

Recently I had spoken with a client's grandparents whom had established a 529 Savings Plan in the State of Florida for him when he was...

-

The good folks over at Boom & Bucket have reached out to me to help spread the word on their on-going Student Scholarship Program. Ple...

-

Occasionally my partners will reach out with a new article, or post, or blog entry with relevant information to the A+ program. The good fo...